Building Momentum:

A New Partnership for Nature Fresh Farms

Nature Fresh Announces Minority Investment

by Manulife Investment Management

LEAMINGTON, ON & BOSTON, MA– Nature Fresh Group Inc. (“Nature Fresh”) has announced today a minority investment made by Manulife Investment Management (“Manulife IM”), on behalf of its agriculture clients, in Nature Fresh. This new investment will help to position Nature Fresh for further success and will leverage the combined expertise of both firms to drive continued growth in the controlled environment agriculture sector.

Peter Quiring will remain the majority shareholder of Nature Fresh following the transaction, and commented, “We are excited to partner with Manulife IM, whose deep knowledge and long-term vision in the agriculture sector align perfectly with our goals. This minority investment represents a strategic collaboration that will help us accelerate innovation and enhance value for our customers and stakeholders.”

Oliver Williams, Global Head of Agriculture Investments at Manulife IM, added: “Nature Fresh has built an impressive legacy in the industry, and we are thrilled to support their next phase of growth. This investment reflects our confidence in their vision, leadership, and commitment to advancing their sustainable agriculture practices. We see significant potential in this new relationship to create a lasting impact, and we are eager to contribute our experience and resources to help Nature Fresh achieve its long-term goals.”

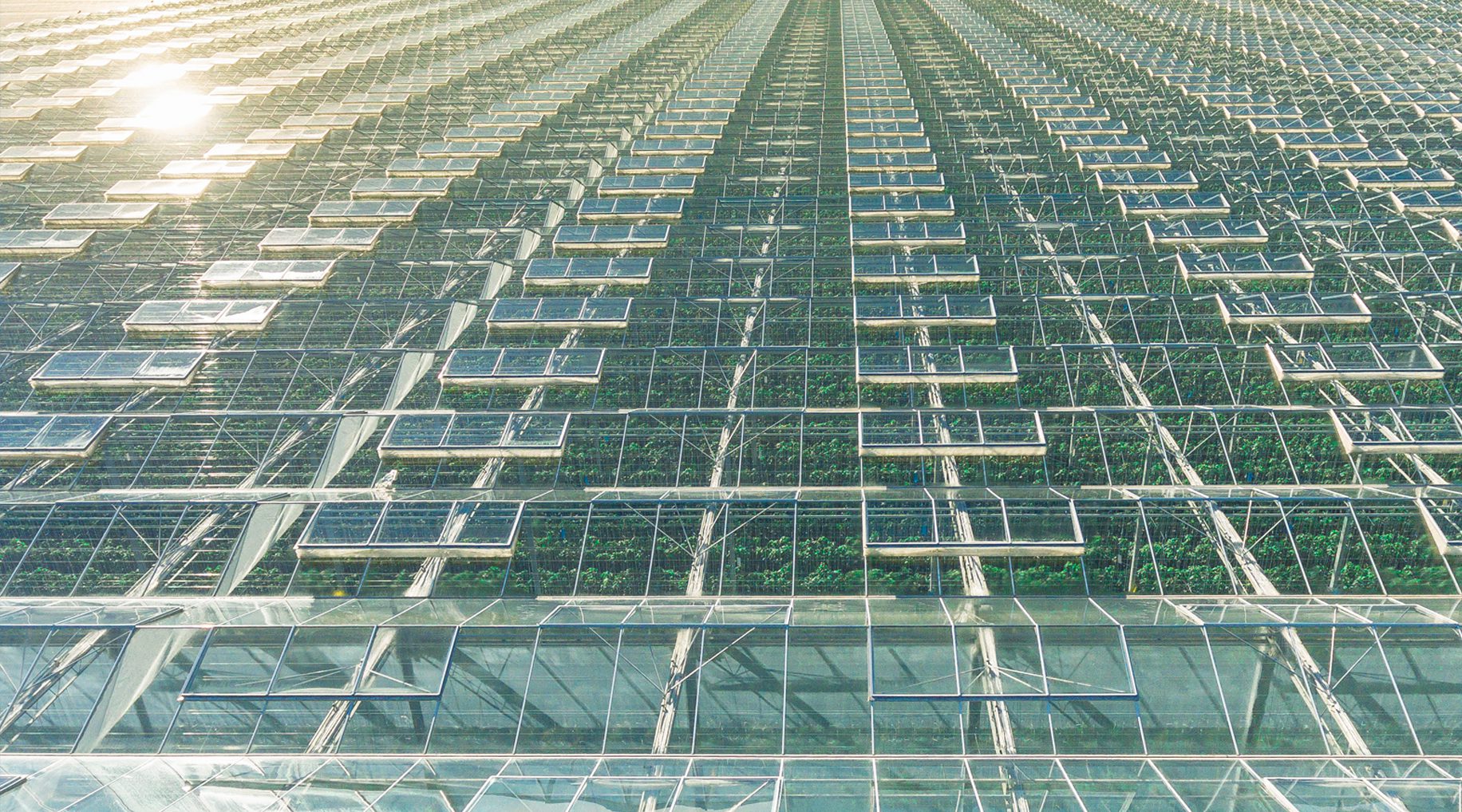

Nature Fresh is a pioneer in sustainable greenhouse agriculture, producing premium fruits and vegetables year-round through advanced technology and innovation. Committed to quality and sustainability, Nature Fresh provides customers with fresh, flavourful, and safe produce.

As part of Manulife Wealth & Asset Management, Manulife IM is a leader in bringing natural capital solutions to investors around the globe and is the largest manager of natural capital in the world.1 It manages nearly 400,000 acres of prime farmland in major agricultural regions of the United States and in Canada, Chile, and Australia as part of its comprehensive private markets strategies.

1 IPE research, as of January 29, 2024. Manulife IM ranking is based on total natural capital assets under management (AUM),

which include forestry/timberland and agriculture/farmland AUM. Firms were asked to provide AUM and the as of dates vary

from December 31, 2022, to December 31, 2023.

About Manulife Wealth & Asset Management

As part of Manulife Financial Corporation, Manulife Wealth & Asset Management provides global investment, financial advice, and retirement plan services to 19 million individuals, institutions, and retirement plan members worldwide. Our mission is to make decisions easier and lives better by empowering people today to invest for a better tomorrow. As a committed partner to our clients and as a responsible steward of investor capital, we offer a heritage of risk management, deep expertise across public and private markets, and comprehensive retirement plan services. We seek to provide better investment and impact outcomes and to help people confidently save and invest for a more secure financial future. Not all offerings are available in all jurisdictions. For additional information, please visit manulifeim.com.

Advisors and Counsel

In connection with the minority investment, BMO Capital Markets acted as sole placement agent on behalf of Nature Fresh. BMO Commercial Banking continued its long-term role acting as sole syndicate agent, and lead syndicate lender to Nature Fresh. McCarthy Tétrault LLP acted as legal advisor to Nature Fresh. Vireo Capital acted as financial advisor and Stikeman Elliott LLP acted as lead legal advisor to Manulife IM.